(Based off of the SHPOA 2024 year end finance report)

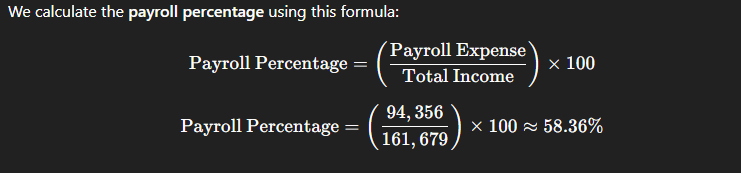

1. Payroll Percentage of Total Income

2. Interpretation of the 58.36% Payroll Percentage

A payroll percentage of 58.36% means more than half of your total income is being used to cover payroll expenses.

This is significantly high in the context of a Property Owners Association. Here’s how it can affect your POA:

3. Impact on SHPOA

| Category | Implication |

|---|---|

| Budget Flexibility | With 58% of income tied up in payroll, there’s less money available for maintenance, repairs, reserves, amenities, or improvements. |

| Reserves & Long-term Planning | It could restrict your ability to build or maintain a healthy reserve fund for future capital projects. |

| Dues Pressure | May increase the likelihood of raising HOA dues or special assessments to fund other necessary expenses. |

| Operational Risk | High payroll reliance can expose the POA to risk if income decreases (e.g., delinquent dues, fewer members). |

| Value to Members | Owners might question the value they’re receiving if a large portion of their dues goes to payroll rather than tangible community improvements or services. |

4. Typical Benchmarks (for reference)

While it varies, most POAs aim to keep payroll (including management, maintenance staff, etc.) between 25%–35% of the total income. At 58.36%, SHPOA is well above that range.

5. Next Steps

- Review Staffing Needs: Are all positions essential? Can some roles be outsourced or combined?

- Efficiency Audit: Consider a third-party review of operational efficiency.

- Member Communication: Be transparent about payroll costs and how they support community services.