Top Red Flags

- Payroll Expenses Missing

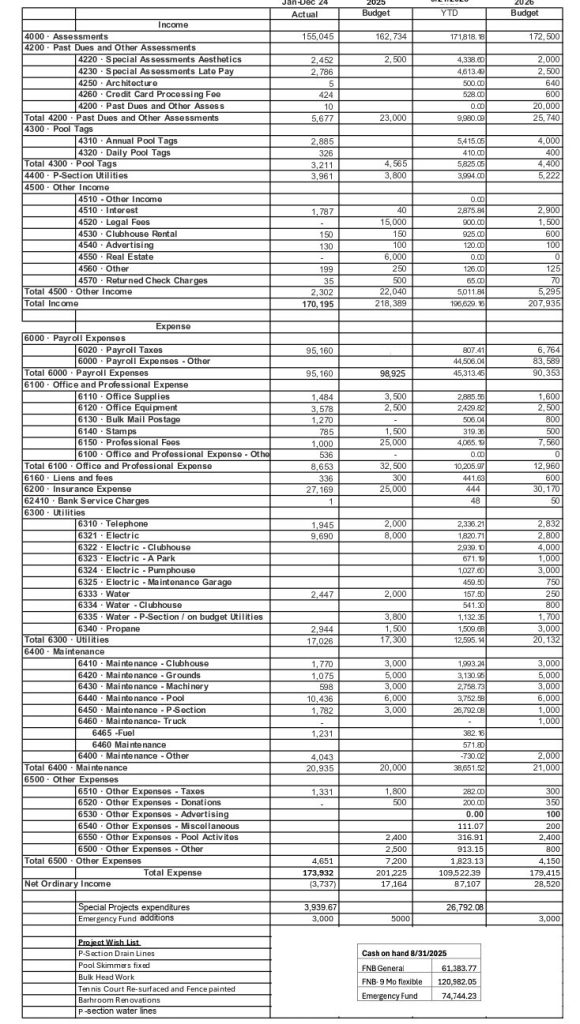

- Report shows $95,160 in payroll taxes but no wages or salaries listed.

- Strongly suggests misclassification or omission of major expenses.

- Insurance Expense Underreported

- 2024 actual insurance was $27,169, but YTD 2025 shows only $444.

- This is highly irregular for a recurring, mandatory cost.

- Unrealistic Income Forecasts

- “Past dues” budgeted at $23,000–$25,740, while only $5,677 was collected in 2024.

- Legal fees projected at $15,000 despite historical income under $2,000.

- Improper Revenue Assumptions

- Returned check charges are listed as planned income. This is not a reliable or appropriate revenue source.

- Expense Irregularities

- Utilities under-budgeted while actual costs run much higher.

- “Maintenance – Other” shows a negative expense, indicating possible errors.

- Pool activities repeatedly budgeted despite little to no spending history.

- Surplus Projections Not Credible

- 2024 ended with a loss of ($3,737).

- Yet budgets project large surpluses ($17,164 in 2025, $28,520 in 2026).

- These projections are based on inflated income and understated expenses.

Why This Matters

While the association currently holds strong reserves ($256,510 total cash), repeated budgeting errors, inflated projections, and missing expenses could quickly erode financial stability.

Recommendations

- Correct and disclose all payroll and insurance expenses.

- Base income and expenses on real historical data.

- Remove improper revenue categories.

- Commission an independent audit for transparency and accountability.

Bottom Line:

The budget, as presented, is unreliable and may mislead property owners. Immediate corrective action and independent oversight are needed.